Do NOT Call Back If Your Phone Shows These Red Flags!

In a world where our phones never stop buzzing, most of us assume every missed call or unknown number deserves a response. But some calls aren’t harmless—they’re traps. Scammers have mastered the art of using urgency, confusion, and simple curiosity to rope people into conversations designed to steal money, gather personal info, or trick them into revealing something they shouldn’t. They can mimic local numbers, impersonate government agencies, or disguise themselves as companies you trust. Their biggest weapon isn’t technology—it’s your instinct to respond.

The danger comes from psychology, not just the scam itself. A missed call triggers the same reflex that makes people answer a knock at the door: What if it’s important? What if ignoring it causes a problem? Scammers understand this and rely on your reaction, not your reasoning.

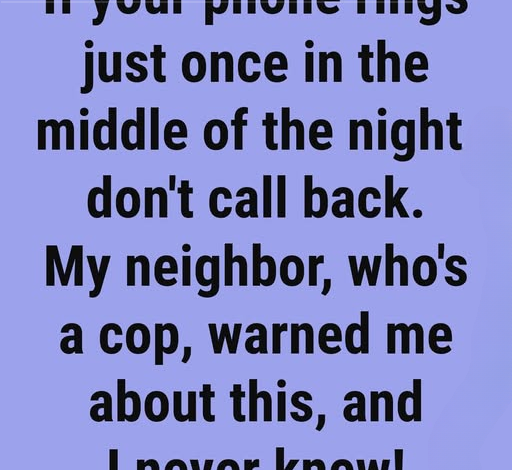

The smartest move you can make is surprisingly simple: pause. Let the call ring. Let the voicemail sit. Don’t return texts from unknown senders. Legitimate organizations don’t play guessing games—real emergencies don’t start with a mysterious phone number and zero information. If anyone truly needs you, they will leave a message or contact you through official channels.

Scam calls, on the other hand, thrive on uncertainty. They prey on silence, hoping you’ll fill in the blanks by calling back. If your gut says something feels “off,” trust it. Verify everything before responding. Look up the number on the company’s real website. Search online. Call your bank or doctor using their official customer-service line—not the number that contacted you.

If you’ve already answered a suspicious call, don’t panic. Scammers try to record your voice or gather bits of information, but the call itself isn’t the real danger—what you do next is what matters.

Monitor your accounts closely for anything unusual. Set up alerts so you know instantly if there’s unauthorized activity. Change your passwords—use long, unique combinations that aren’t repeated elsewhere. Turn on two-factor authentication across your accounts. These steps create a barrier that scammers can’t easily bypass, even if they managed to gather minor details about you.

If you spot anything strange—unexpected charges, sudden waves of spam messages, signs that an account was accessed—contact your phone carrier and bank immediately. They’ve seen every scam imaginable. They know how to block numbers, freeze accounts, and stop damage before it spreads. The quicker you act, the better protected you are.

Healthy skepticism is no longer optional—it’s protection. Ignoring a sketchy number isn’t rude. Deleting a vague voicemail isn’t overreacting. Hanging up on someone who pressures you for information isn’t paranoia. It’s smart, and scammers hate it.

Your phone holds your entire life—banking apps, medical info, photos, conversations, passwords. That makes it a valuable target. Scammers count on you forgetting how much is at stake. They hope you’ll trust a local-looking number or call back a one-second missed call without thinking.

Your awareness is your defense.

If a message feels strange, trust that feeling. If a call demands urgency that doesn’t make sense, step back. If someone tries to rush you into sharing information, disconnect. Scam artists can fake identities, spoof numbers, and imitate authority—but they can’t override your instincts.

Staying safe doesn’t require advanced tech skills. It just requires slowing down, noticing red flags, and refusing to let strangers steer your reactions. In a digital world filled with noise, sometimes the safest and smartest response is silence.

Ignoring a suspicious call doesn’t isolate you—it protects your privacy, your finances, your identity, and your peace of mind. All of that is far more valuable than returning a call that never should’ve been answered in the first place.